Due to the indecisive nature of f Peter Thiel, the venture capital company Founders Fund has earned an inglorious reputation through its controversial approach. But now, a fund-unrelated gaming enthusiast from PayPal’s mafia, Brian Singerman, is engaging in the game and lifting it to new highs — for as long as Thiel’s controversial policies don’t get in the way.

At the end of March 2014, it has just hit past midnight after a tense day when Brendan Iribe failed to restrain emotions as he sent an email to his most trusted advisors. Iribe, the 37-year-old co-founder and former CEO of Oculus VR, had just ended a phone call with Mark Zuckerberg, the 32-year-old CEO and co-founder of Facebook. The two young entrepreneurs were prepared to conclude a megadeal that would shock the entire tech industry, namely that the world’s largest social network would buy the hottest virtual reality start-ups. It was only a few hours before the deal was concluded, but the two still couldn’t agree on the sales price, which, based on the Facebook’s stock value, would be quite remarkable. Iribe was adamant — the price must be two billion dollars. But to Facebook it seemed too high due to the dipping stock price of Facebook. And the deal was suddenly jeopardized.

Oculus and its virtual-reality system, the Rift, was already considered a novelty to the technology world, and Iribe had some of the industry’s most influential people’s telephone numbers at hand. Marc Andreessen was on company’s board, while Founders Fund, co-founder of which is Peter Thiel, was an investor. But none of them were picking up. It was Thiel’s colleague, Brian Singerman, a 40-year-old software fan and one of the newest partners at the firm. By 1 a.m., with Singerman’s help, Iribe had prepared an offer that would delight Oculus team and wouldn’t make Facebook renegotiate the terms of the deal again. A few hours later, Facebook announced in a press release that it was buying Oculus for “approximately two billion dollars” in cash, stock and $300 million in future revenue. For investors, this two-year-old company was a precious catch, but Singerman, who saved the deal, was the only one who wasn’t quite satisfied. “I was the first investor to trust them,” he says. “And we could have got a lot more.”

It’s that kind of approach to deals that has turned Singerman, who ranks fifth on this year’s Midas List of America’s best venture capitalists, into the most successful investor at the most boring and controversial venture-capital company in the country. He joined in at the game at the right moment. Since its founding in 2005, Founders Fund has been best known as Peter Thiel’s company. With the election of Donald Trump, Thiel, as a Trump supporter and a close advisor to the left- leaning Silicon Valley, has become an unwanted figure — an outsider and outcast. He’s been severely criticized for normalizing an administration whose policies many consider an absolute contradiction to the interests and values of the industry. His presence on the Facebook board has been questioned; though not by Zuckerberg. Some entrepreneurs even say they won’t accept Thiel’s money, and some venture-capital firms are openly expressing a desire to keep their distance. Singerman is determined to not get involved in this fight. “We are trying to be politically neutral,” he expresses his position.

The Founders Fund is no amateur when it comes do disputes. At its very beginning, it declared itself a venture-capital firm for those who disliked other companies in the field. The partners established their office in San Francisco Presidio, near the Golden Gate Bridge, 56 kilometres North of Sand Hill Road in Menlo Park, where a lot of venture-capital firms are located. In 2011, they publicly expressed support in thinking outside of the box and rebuked their peer venture capitalists: “We wanted new technologies, instead we got 140 new social-application companies.”

By often betting on projects their competitors deemed too risky, Founders Fund built a portfolio that other firms could only dream of. For every dollar spent by investors in their first fund, including Facebook, they gained seven. Thanks to successful o projects like Spotify, Palantir and SpaceX, the second fund might do even better. The latest projects have nearly quadrupled in value, at least on paper, in terms of investment measuring to such giants as Airbnb, Lyft and Wish. The company, founded in 2005 with a $50 million fund, is on the right track to generate more than 9.5 billion in returns.

Brian Singerman (in the middle) is one of the best gamers in Silicon Valley. His victims (from left): partner Cyan Banister, AltSchool CEO Max Ventilla, The Climate Corporation cofounder David Friedberg, Emerald Therapeutics cofounder Brian Frezza, Oculus VR cofounder Brendan Iribe and Affirm CEO Max Levchin.

One of Founders Fund’s tricks is to support their friends. Along with Reid Hoffman and Elon Musk, Peter Thiel is one of the most famous members of the so-called PayPal mafia — a group of entrepreneurs who developed this payments site and became wealthy when it was sold to eBay in 2002. Thiel invested in Musk’s SpaceX and Yammer created by PayPal CEO David Sacks. The Mafia also owns Palantir, which Thiel helped to start, and Max Levchin’s Affirm. Thiel has been a convincing face of the company, just like clan’s Vito Carleone.

But things changed when Singerman emerged as a power player. The only partner in the company who hasn’t participated in its founding has had more successful investments over the past five years than any of his colleagues, including Thiel. It was Singerman who fiercely tried to get his colleagues into biotech in 2012, an industry they knew very little about. And now none of them are complaining about it… Singerman’s audacious $300 million bet on Stemcentrx — this company makes drugs that attack cancer stem cells — paid off when it was bought by the pharmaceutical giant AbbVie in April 2016. The investment has delivered a profit of $1.4 billion.

On the top floor of a large office building near the entrance to the Presidio Park, three of Founders Fund’s partners are analysing a brief summary of the start-up influx from early March. With Singerman listening from behind a standing desk, Scott Nolan and Cyan Banister speak of the start-up’s financing team being strong and experienced and with smart strategies for using technology in agriculture. Banister says she has met some similar companies. Fifteen minutes later, the trio decides to wait until a clear winner emerges, whose interest the firm will then attract by a huge check.

The Founders Fund has earned the honour of being the best venture capitalist through highly considered bets on just a few companies, spotting a market leader first and then participating in its future funding rounds. It is a well-considered approach that also includes a lot of risk. And yet Founders Fund has never lost more than ten million dollars on a bad deal. “That’s why you’re signing up for it, too,” says Dan Feder, a Founders Fund investor who oversees a large proportion of Washington University subsidies. “There are very few venture-capital firms able to recognize promising start-ups and make big investments in them.”

Changing the business practice of a venture capital firm has been Founders Fund’s approach since early beginnings. Thiel and co-founders Ken Howery and Luke Nosek had met with dozens of venture investors during PayPal development, and it was no surprise to them. One helped to set up a rival company, someone else tried to replace the founders with a former management team. Being excited about the money raised from the PaypPal sale to eBay in 2002, the trio was already investing in their friends’ businesses at the time, helping Thiel run a small personal fund. “We spent a whole year trying to create a venture capital company that we would actually like,” Nosek says.

Their ideal venture capital company, characterized by the name Nosek came up with, would stand by start-up founders. That would help, of course, but wouldn’t interfere. It would not ban financing rounds, push a start-up to sell or even demand a board seat. And if the start-up faltered, Founders Fund would not push out its founders. “Something like that is not imaginable right now, but a decade ago this was a pretty radical practice,” says Kevin Hartz, the cofounder and former CEO of Eventbrite — Thiel’s friend from studio time. Thiel joined Eventbrite last autumn.

If only the game industry had developed a few years earlier, Brian Singerman could have become not a venture capitalist but instead a professional gamer.

Founders Fund earned well early on thanks to the relationship with Facebook.Thiel, who initially netted the first $50 million in the fund, became the first investor in Zuckerberg’s social network, eventually turning eight million dollars into 376 million. Soon after, Facebook’s president Sean Parker joined as a general partner. After a series of successful investments, Founders Fund surprised San Francisco’s Bay Area business circles in 2008 by investing $20 million into SpaceX, the rocket-science start-up founded by Musk. “It wasn’t really clear to anyone whether that was going to work out,” Howery says. “Every rocket had blown up.” One potential investor withdrew. Another accidentally forwarded partners’ email that said they had completely lost their minds. While SpaceX’s future remains uncertain, the company’s value is now estimated at $12 billion, and 8% of which belongs to Founders Fund.

When funds grew from $225 to $250 million and later to as much as $625 million, the company remained, in the words of Eric Ries, author of The Lean Startup, “Peter and Sean Show.” That changed when Singerman, who had been hired as a senior associate in 2008, was promoted to partner in 2011 and successfully replaced Parker, who resigned to pursue other ideas. At that time, Founders Fund hit the jackpot once again with DeepMind the artificial-intelligence company, which was bought by Google for more than $500 million in 2014, and The Climate Corporation, which uses sensors to monitor weather, soil and field conditions to improve productivity and was acquired by Monsanto for $1 billion in 2013. The company’s $150 million investment in Airbnb is now worth about $1.4 billion, and the $100 million invested into Stripe has roughly quadrupled in value. Its biggest investment so far, however, has been between 2012 and 2015 — Singerman’s audacious $300 million investment in Stemcentrx. In April, AbbVie bought Stemcentrx for $10.2 billion. Founders Fund owned about 16 percent.

Brian Singerman could have become a professional gamer, not a venture capitalist, if only the gaming industry developed a few years earlier. He grew up in Los Angeles in the family of a doctor and teacher. When he was young, he developed an affinity for programming and various games, whether they were digital or analogue. In the 1990s, Brian won national tournaments for Settlers of Catan, a popular board game. While studying at Stanford, he spent a summer in Europe—partly to get rid of an addiction to the online role-playing game EverQuest, on which he spent more time than in his computer-science classes.

After a brief stay at a failed start-up, Singerman joined Google in 2004, where he helped develop a personalized website called iGoogle. Word quickly spread that he was a champion player of a 2002 fighting videogame, SoulCalibur II. When his colleagues asked him to play, Singerman agreed to play as long as there was money on the line. At Google’s pre-IPO period, some of his colleagues didn’t have spare cash. “They put equity at stake,” Singerman says now with a laugh. His winnings were promissory notes, which colleagues could redeem after Google’s IPO, when they were able to sell some of their shares.

Singerman continued to invest in startups and created a million-dollar fund called XGYC (an abbreviation of “ex-Google and Y Combinator,” after the accelerator where he found most of his best deals). He turned to two major investors for advise in seed-stage deals — Ron Conway (ranked No. 43 on this year’s Midas List) and Steve Anderson (No. 4), who helped Singerman find his first big win— Heroku, which Salesforce acquired for $212 million in 2010. Singerman also attracted the attention of Parker, who saw him as an opportunity to add Google’s network to Founders Fund’s deal flow run by PayPal and Facebook at that time. In 2008 Parker persuaded him to join the company for a short time. As one of the two junior investors there, Singerman met with more than 1,000 companies in his first year of work.

Singerman’s excellent gamer skills revealed on a Thursday night when he skilfully defeated a group of friends at a board game called Scythe. It was the first time for any of them to play it, and that’s the point — Singerman likes to try new games with his friends and checks who’s the fastest in mastering the rules of the game and the playing styles. He certainly isn’t from those who spend the previous night watching YouTube tutorials on game strategic complexity.

The skilful observation and methodical research has helped Singerman in investing. He realized sooner than others that Oculus and its virtual-reality system could someday become something more than just a gaming device, and he jumped ahead of others. He saw Airbnb’s potential to expand into services that would supplement room rentals. And he applied his skills to different areas, such as wearable technology called Misfit and classroom technology AltSchool.

Ahead of his meeting with Mario Schlosser, the CEO of Oscar Health, (the company that focuses on cheap health insurance), Singerman had been delving into research on health care. “Within half an hour, he called his partner Ken to say he had to act immediately,” Schlosser says. He and co-founder Josh Kushner, whose job was based in New York, decided to stay in San Francisco for an extra day, spending most of the night awake and discussing Oscar Healthwith Singerman and team over beer. Founders Fund later became the biggest external investor in Oscar.

Despite the healthy returns from Oculus, Singerman’s disappointment in not placing a higher stake on this case contributed to his decision to change his investing strategy. He led multiple rounds of financing at AltSchool. Singerman, however, managed to enter into the Series C at Climate Corporation after failing to engage in earlier rounds and ended up buying more shares from company employees to maximize his position. Such a strategy he now uses regularly.

No deal reveals his double strategy as good as Stemcentrx. Singerman had been studying biotech efforts to stop the development of various forms of cancer since he met co-founder and CEO Brian Slingerland at a coffee shop near his house late in 2011. After a brief conversation, he urged Slingerland to postpone all plans and come to Thiel’s house that very night for his holiday party. Slingerland hesitated for a moment because it was his first wedding anniversary but quickly he realized that he couldn’t pass this opportunity. Instead of taking his wife out for romantic dinner, he spent the evening with Singerman, Thiel and other partners, talking about cancer stem cells.

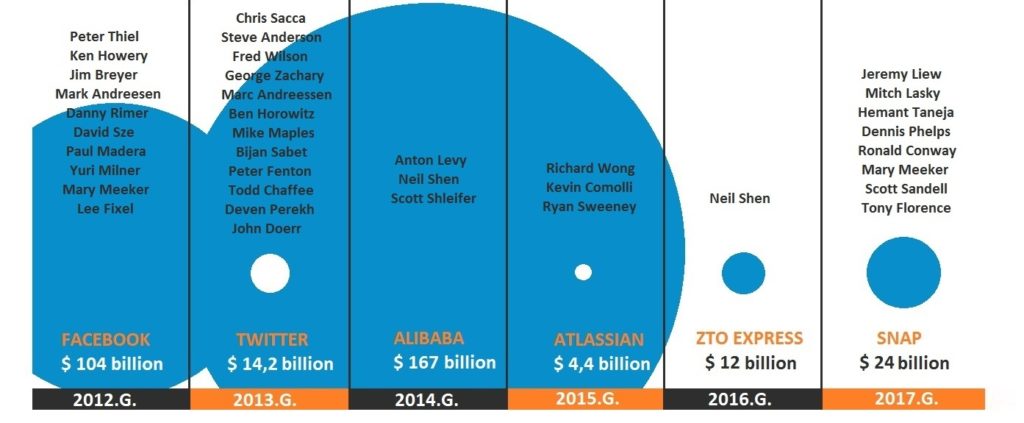

Largest venture capital backed IPOs from 2012 to 2017

THE QUICKEST WAY TO ENTER A MIDAS LIST-TO SUPPORT COMPANIES THAT ARE PUT INTO PUBLIC CIRCULATION, SUCH AS SNAP. THE GREATER AND BOLDER THE INVESTMENT, THE BETTER.

If Singerman had any doubts about Stemcentrx they disappeared as soon as the experts he sent to evaluate the company asked for a possibility to invest themselves. When he told friends that he was injecting huge sums into the biotech company, they wrote it off as typical Founders Fund’s bold doing. “I said he was high,” recalls former Hollywood agent Michael Ovitz, who had befriended the Silicon Valley venture capitalists like Andreessen and Thiel and co-invested in Stemcentrx with Founders Fund.

Eager to increase his influence, Singerman led the next round of financing, in 2014, when one of Stemcentrx’s drugs proved to be promising. Through company employees he bought additional shares, any he could find. By the time of negotiations with AbbVie, Singerman was all in. He called Slingerland so often that friends thought because of their similar names, he was talking to himself. He spent nights and holidays at Stemcetrx headquarters in South San Francisco, almost always wearing company’s T-shirt, which began to wear off from frequent use. When the founders discussed whether to sell the company, Singerman, as usual, didn’t stand on either side. “He helped us consider all options and then said: “You are the founders,” Slingerland recalls. Singerman just adds, “What was I going to say? Cure cancer faster?”

On election night, at the house of Dustin Moskovitz, the Facebook billionaire cofounder — who had donated $35 million to support Hillary Clinton’s campaign—Singerman watched Trump win. None of them had voted for Trump. The next day, Singerman went back to work. His partner Thiel decided to go to New York to become the leader of Trump’s transition team. When tech world leaders, such as the CEOs of Alphabet, Amazon and Apple, arrived at Trump’s tasteless headquarters in December, Thiel sat down just next to the newly elected president. His coworkers are not surprised by his his willingness to engage in politics: they see it as one of Thiel’s new projects, alongside the hedge fund, Founders Fund, charity foundation and book tour. “He’s always had thousand things going on,” Howery says. But many opinions differed in the politicized Silicon Valley. At a conference in June, Ryan Petersen, the CEO of one of Founders Fund’s most promising start-ups, Flexport, drew attention by declaring that he would probably not accept Thiel’s money for the second time due to his political involvement. On election night, David Heinemeier, the Danish creator of popular Web app framework Ruby on Rails and bestselling author, tweeted to his more than 200 thousand Twitter followers that Y Combinator, in which Thiel is an advisor, could have its future companies work on a deportation app and nailed it by adding the #foundersfund hashtag.

After all this fuss, Facebook and Y Combinator were required to break ties with Thiel. Both Zuckerberg and Y Combinator president Sam Altman refused to do so, and the fuss soon subsided. Some investors told Financecounter in a private conversationthat several start-up founders declined meetings with the firm because of Thiel. Mark Suster, of Upfront Ventures, does not hide that he is worried about Trump’s views on issues like race differences, the LGBT rights and health care: “I would like to know Thiel’s views on those topics before I co-invest with him.” Some other venture capitalists are concerned about it, too. “I think it could affect their profitability, because how could it not?” says another investor who is close to the firm. The connection is that Thiel’s cooperation with Trump will not help, but Founders Fund will not miss the deals others never see.

Disagreements over Trump also sparked internal tensions. One of the partners, Tray Stephens, joined Thiel on the transition team, while another, Geoff Lewis, published a very harsh comment online: “A world in which President Trump is right about anything is not the world I want my grandchildren to inherit.” He also wrote on Twitter of those joining the government transition team: “How principles trade for a delicious bite of a hot kleptocratic pie.” Later, though, he deleted that post and now claims that the site has become too toxic.

Like it or not, but Singerman and his colleagues cannot avoid the topic.In February, Nolan, Stephens and Singerman looked surprised in their office when a visiting founder of some company asked them whether politics, particularly Trump’s immigration policies, had an impact on their investments. “No one had asked us that question before,” Nolan says. Later, drinking lemon water in his office, Singerman was still angry that the company needs to take public positions on what he believed was absolutely personal. “It’s a pretty scary time in the country right now when everyone is convinced they are absolutely right,” he says. “The answer is usually more neutral.”

Thiel has been cautious in recent months. In February and March, he joined the other partners only occasionally, usually by phone or videoconference, to discuss several large (and still secret) deals. When Financecounter finally succeeded in meeting him, although remotely, because he was in Europe, Thiel said that as the company makes only a “few important investments” every year, his various interests help him “to see the big picture better.” Moreover, Thiel argued that his political views had no effect on the company. “My role at Founders Fund is an investor, nothing more.”

After all, it looks like all the talk over Thiel’s close connection with Trump are nothing more than plain rumours, as money and greed turn out to be stronger than politics and principles. Until now, the only person who has publicly returned Thiel’s money wasn’t the CEO of one of his portfolio companies but a 21-year-old fellow. He received $100 thousand from Thiel’s Philanthropy Program that encourages students to withdraw from university and start their own businesses. Meanwhile, Petersen, the Flexport CEO who preached that the second time Thiel’s money would no longer be accepted, is now telling that he had an open and constructive conversation with the partners, including Thiel, about politics. What was the outcome? “I regret what I said and would gladly accept additional investment from Founders Fund if the opportunity would arise,” Petersen says now.